Links

Abstract

Latent variables are ubiquitous in macroeconomics and structural models are often used to characterize and estimate them from empirical data. This paper addresses the problem of identifying the key sources of information with respect to latent variables in dynamic stochastic general equilibrium models. To that end, I show how to evaluate the information content of a set of observable variables with respect to a given latent variable. The methodology enables researchers to measure and compare the informational contribution of different observables and identify the most informative ones. Thus, it provides a framework for a rigorous treatment of such issues, which are often discussed in an informal manner in the literature. The methodology is illustrated with an assessment of the informational importance of asset prices with respect to news shocks in the business cycle model developed by Schmitt-Grohé and Uribe (2012).

Figures

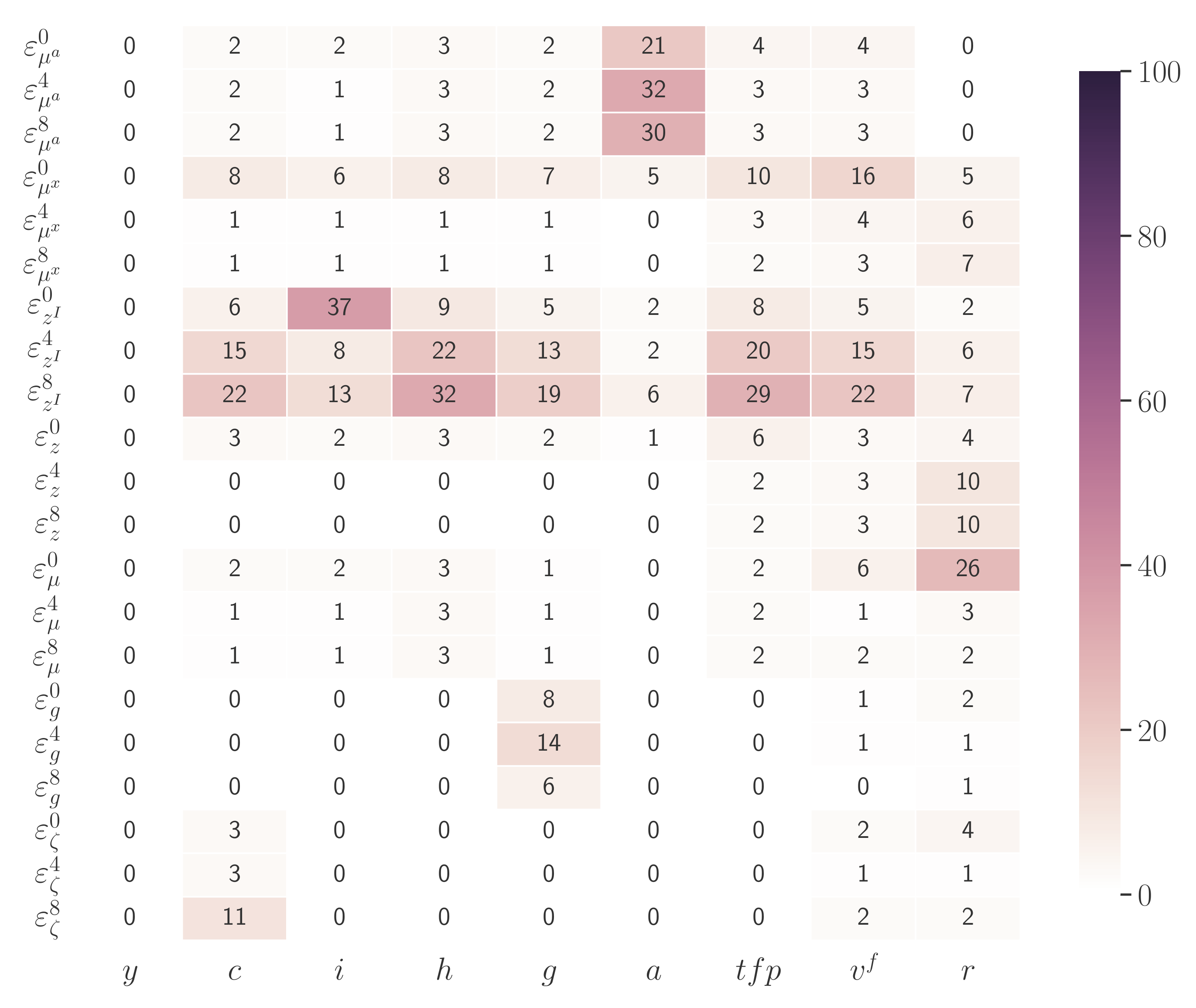

Figure 1: Conditional information gains about the shocks in the SGU model

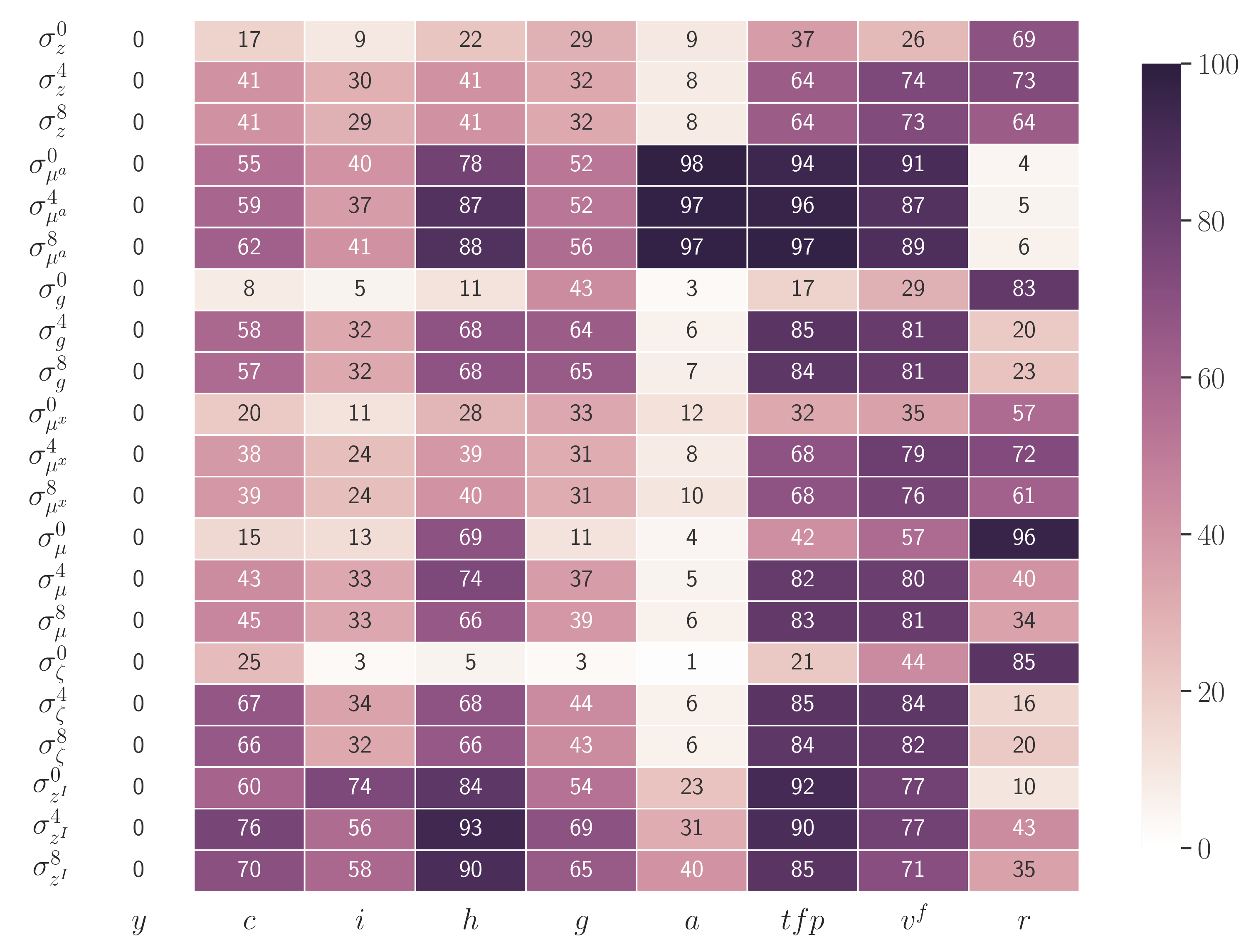

Figure 2: Efficiency gains about the shock parameters in the SGU model

Citation

@article{ISKREV2019318,

title = {On the sources of information about latent variables in DSGE models},

journal = {European Economic Review},

volume = {119},

pages = {318-332},

year = {2019},

issn = {0014-2921},

doi = {https://doi.org/10.1016/j.euroecorev.2019.07.012},

url = {https://www.sciencedirect.com/science/article/pii/S001429211930131X},

author = {Nikolay Iskrev},

keywords = {DSGE models, Information content, Identification, News Shocks, Asset prices},

abstract = {Latent variables are ubiquitous in macroeconomics and structural models are often used to characterize and estimate them from empirical data. This paper addresses the problem of identifying the key sources of information with respect to latent variables in dynamic stochastic general equilibrium models. To that end, I show how to evaluate the information content of a set of observable variables with respect to a given latent variable. The methodology enables researchers to measure and compare the informational contribution of different observables and identify the most informative ones. Thus, it provides a framework for a rigorous treatment of such issues, which are often discussed in an informal manner in the literature. The methodology is illustrated with an assessment of the informational importance of asset prices with respect to news shocks in the business cycle model developed by Schmitt-Grohé and Uribe (2012).}

}