ARCH

Contents

ARCH¶

import warnings

warnings.simplefilter("ignore", FutureWarning)

import matplotlib.pyplot as plt

import seaborn as sns

sns.set_theme()

sns.set_context("notebook")

import pandas as pd

import sqlite3

Conditional heteroskedasticity¶

Time series models are (largely) models of the temporal dependence observed in time series data

the future depends of the past

the past is informative about the future

Central objective of time series modeling is characterizing temporal dependence, i.e. characterizing

or characterizing some of its moments, such as

So far, we have seen models for the conditional mean.

for example, in \(z_t = \alpha z_{t-1} + \varepsilon_t\) the conditional mean is

changes with \(z_t\)

However, the assumptions about \(\varepsilon_t\) imply that \(\operatorname{var}(z_{t+h} | z_{t}, z_{t-1}, \cdots) \) is a constant (independent of \(z_t, z_{t-1}, \cdots\))

for example, in \(z_t = \alpha z_{t-1} + \varepsilon_t\)

independent of \(z_t\)

Gaussian time series model¶

Forecasts

\(\operatorname{E}(\mathbf{z}_2 | \mathbf{z}_1) = \boldsymbol \mu_2 + \mathbf{\Sigma}_{2 1} \mathbf{\Sigma}^{-1}_{1 1} (\mathbf{z}_1 - \boldsymbol \mu_1)\;\;\;\;\;\) function of \(\mathbf{z}_1\)

\(\operatorname{cov}(\mathbf{z}_2 | \mathbf{z}_1) = \mathbf{\Sigma}_{2 2} - \mathbf{\Sigma}_{2 1}\mathbf{\Sigma}_{1 1}^{-1}\mathbf{\Sigma}_{1 2}\;\;\;\;\;\;\;\;\;\) constant

More generally, if

then

and

For \(\operatorname{var}(z_{t} | z_{t-1}, z_{t-2}, \cdots)\) to vary with \((z_{t-1}, z_{t-2}, \cdots)\), we need \(\operatorname{var}(\varepsilon_{t} | z_{t-1}, z_{t-2}, \cdots)\) to be a function of \((z_{t-1}, z_{t-2}, \cdots)\)

where \(h(.)\) is non-negative

and therefore

conditional heteroskedasticity models are models for \(\sigma^2_t\)

\(\sigma^2_t = \sigma^2\) - homoskedasticity

\(\sigma^2_t \neq \sigma^2\) - heteroskedasticity

Autoregressive conditional heteroskedasticity (ARCH) models¶

ARCH(1)¶

\(\omega_0>0\), \(\omega_1 \geq 0 \) (for \(\sigma^2_t\) to be positive)

large shocks (\(\varepsilon_{t-1}\)) are expected to be followed by other large shocks ( large \(\operatorname{var}(\varepsilon_{t} | z_{t-1}, z_{t-2}, \cdots)\) )

Since \(\varepsilon_{t}\) is innovation process (unpredictable)

we have

and defining \(\nu_t = \varepsilon^2_{t} - \operatorname{E}_{t-1}(\varepsilon^2_{t}) \)

From

and

follows

and

AR(1) model for \(\varepsilon^2_{t}\)

\(\varepsilon^2_{t}\) are positively autocorrelated (\(\varepsilon_{t}\) are uncorrelated)

stationarity: \(\omega_1<1\)

unconditional mean of \(\varepsilon^2_{t}\) :

unconditional variance of \(\varepsilon_{t}\):

\(\varepsilon_{t}\) and \(z_t\) are stationary (unconditional moments are time-invariant)

large (relative to \(\sigma^2\)) shocks expected after large (relative to \(\sigma^2\)) shocks

ARCH(q)¶

as before

AR(q) model for \(\varepsilon^2_{t}\)

Estimation¶

Pure volatility models¶

Let

Then, we can write

if \(e_t \overset{iid}{\sim} \mathcal{N}(0, 1)\) the conditional density of \(z_t\) is

because at time \(t-1\), \(\sigma_t\) is known, i.e. a constant

and the conditional log-likelihood of \(z_t\)

the likelihood of \(\{z_1, z_2, \cdots, z_{T}\}\)

Time-varying mean¶

\(\mu_t = \operatorname{E}_{t-1} z_t\)

for example

conditional log-likelihood of \(z_t\)

the likelihood of \(\{z_1, z_2, \cdots, z_{T}\}\)

ARCH models in Python¶

from arch import arch_model

conn = sqlite3.connect(database='FCI_EIKON_long.db')

query ='SELECT * FROM "Eikon-daily" WHERE variable=="STOXXE"'

df = pd.read_sql_query(query, conn)

df = df.set_index('time', drop=True)

df.index = pd.to_datetime(df.index)

df = df.sort_index().dropna()

euro_stoxx = df.drop('variable', axis=1)

euro_stoxx.columns = ['EURO STOXX INDEX']

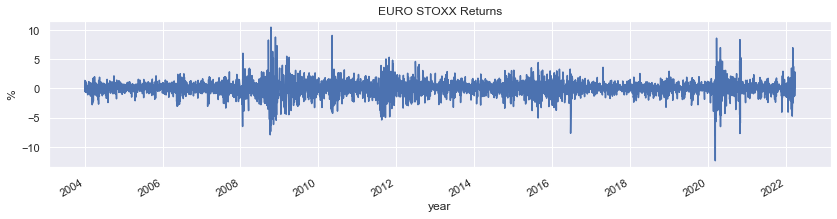

euro_stoxx_returns = 100 * euro_stoxx.pct_change().dropna()['2004':]

euro_stoxx_returns.columns = ['EURO STOXX Returns']

fig = euro_stoxx_returns.plot(figsize=(14,3), legend=False, title='EURO STOXX Returns', ylabel='%', xlabel='year')

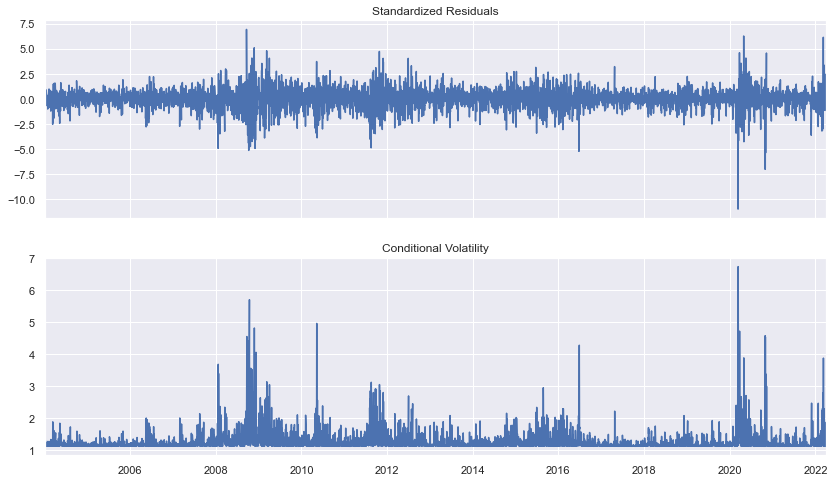

Estimate ARCH(1)¶

arch1 = arch_model(y=euro_stoxx_returns, mean='constant', vol='ARCH')

arch1

res = arch1.fit(update_freq=0)

print(res.summary())

Optimization terminated successfully (Exit mode 0)

Current function value: 7748.798771475143

Iterations: 6

Function evaluations: 33

Gradient evaluations: 6

Constant Mean - ARCH Model Results

==============================================================================

Dep. Variable: EURO STOXX Returns R-squared: 0.000

Mean Model: Constant Mean Adj. R-squared: 0.000

Vol Model: ARCH Log-Likelihood: -7748.80

Distribution: Normal AIC: 15503.6

Method: Maximum Likelihood BIC: 15523.0

No. Observations: 4749

Date: Mon, Apr 04 2022 Df Residuals: 4748

Time: 17:29:15 Df Model: 1

Mean Model

============================================================================

coef std err t P>|t| 95.0% Conf. Int.

----------------------------------------------------------------------------

mu 0.0424 1.852e-02 2.288 2.212e-02 [6.082e-03,7.869e-02]

Volatility Model

========================================================================

coef std err t P>|t| 95.0% Conf. Int.

------------------------------------------------------------------------

omega 1.2266 7.797e-02 15.731 9.201e-56 [ 1.074, 1.379]

alpha[1] 0.2872 4.632e-02 6.201 5.596e-10 [ 0.196, 0.378]

========================================================================

Covariance estimator: robust

fig = res.plot()

fig.set_figheight(val=8)

fig.set_figwidth(val=14)

Forecasting¶

forecasts = res.forecast(reindex=False, horizon=12)

forecasts.variance

| h.01 | h.02 | h.03 | h.04 | h.05 | h.06 | h.07 | h.08 | h.09 | h.10 | h.11 | h.12 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| time | ||||||||||||

| 2022-03-30 | 1.672126 | 1.706939 | 1.716939 | 1.719811 | 1.720636 | 1.720873 | 1.720941 | 1.720961 | 1.720967 | 1.720968 | 1.720969 | 1.720969 |

forecasts.mean

| h.01 | h.02 | h.03 | h.04 | h.05 | h.06 | h.07 | h.08 | h.09 | h.10 | h.11 | h.12 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| time | ||||||||||||

| 2022-03-30 | 0.042386 | 0.042386 | 0.042386 | 0.042386 | 0.042386 | 0.042386 | 0.042386 | 0.042386 | 0.042386 | 0.042386 | 0.042386 | 0.042386 |

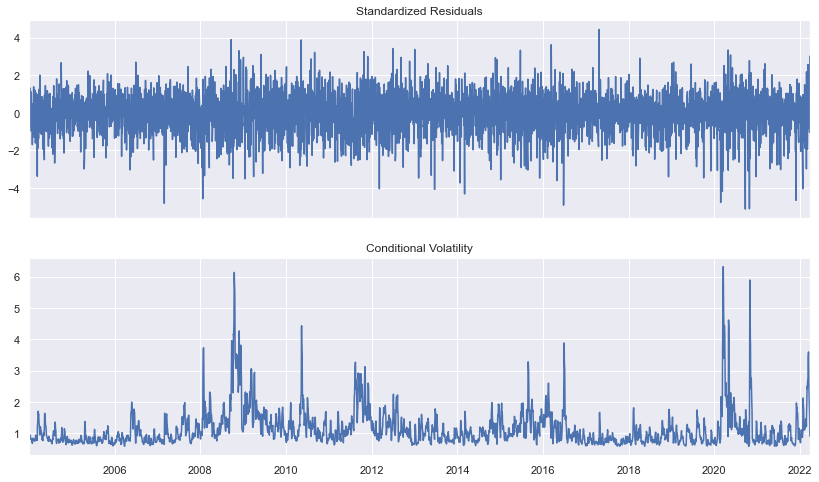

from arch.univariate import ARCH

arch7 = arch1

arch7.volatility = ARCH(p=7)

arch7

res = arch7.fit(update_freq=0)

fig = res.plot()

fig.set_figheight(val=8)

fig.set_figwidth(val=14)

Optimization terminated successfully (Exit mode 0)

Current function value: 7018.71525122455

Iterations: 19

Function evaluations: 216

Gradient evaluations: 19

Specifying model for the conditional mean¶

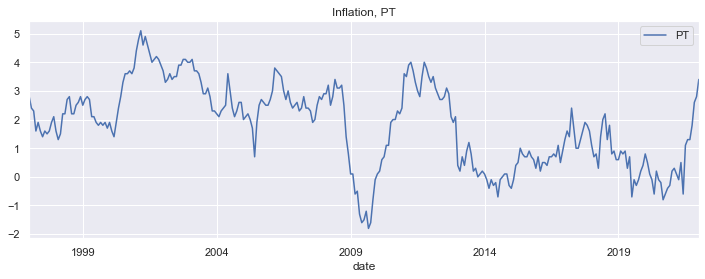

dcpi = pd.read_csv('HICP_unadj_ANR_clean.csv', index_col=0, parse_dates=True)

infl_pt = dcpi[['PT']].copy()

infl_pt.plot(figsize=(12,4), title='Inflation, PT')

<AxesSubplot:title={'center':'Inflation, PT'}, xlabel='date'>

from arch.univariate import ARX

arch_ar_model = ARX(infl_pt,

constant=True,

lags=[1, 12],

volatility=ARCH(p=1))

#arch_ar_model.volatility = ARCH(p=1) # to add volatility if not specified above

arch_ar_model

res_arch_ar_model = arch_ar_model.fit(update_freq=0, disp="off")

print(res_arch_ar_model.summary())

AR - ARCH Model Results

==============================================================================

Dep. Variable: PT R-squared: 0.920

Mean Model: AR Adj. R-squared: 0.919

Vol Model: ARCH Log-Likelihood: -147.565

Distribution: Normal AIC: 305.130

Method: Maximum Likelihood BIC: 323.462

No. Observations: 289

Date: Sun, Apr 03 2022 Df Residuals: 286

Time: 23:43:26 Df Model: 3

Mean Model

===========================================================================

coef std err t P>|t| 95.0% Conf. Int.

---------------------------------------------------------------------------

Const 0.0990 4.107e-02 2.411 1.590e-02 [1.854e-02, 0.180]

PT[1] 1.0056 1.951e-02 51.545 0.000 [ 0.967, 1.044]

PT[12] -0.0646 1.999e-02 -3.232 1.227e-03 [ -0.104,-2.544e-02]

Volatility Model

===========================================================================

coef std err t P>|t| 95.0% Conf. Int.

---------------------------------------------------------------------------

omega 0.1288 1.829e-02 7.039 1.930e-12 [9.291e-02, 0.165]

alpha[1] 0.2623 0.142 1.853 6.389e-02 [-1.515e-02, 0.540]

===========================================================================

Covariance estimator: robust

ar_model = ARX(infl_pt,

constant=True,

lags=[1, 12])

res_ar_model = ar_model.fit(update_freq=0, disp="off")

print(res_ar_model.summary())

AR - Constant Variance Model Results

==============================================================================

Dep. Variable: PT R-squared: 0.920

Mean Model: AR Adj. R-squared: 0.920

Vol Model: Constant Variance Log-Likelihood: -153.943

Distribution: Normal AIC: 315.887

Method: Maximum Likelihood BIC: 330.553

No. Observations: 289

Date: Sun, Apr 03 2022 Df Residuals: 286

Time: 23:43:44 Df Model: 3

Mean Model

==============================================================================

coef std err t P>|t| 95.0% Conf. Int.

------------------------------------------------------------------------------

Const 0.1315 4.353e-02 3.020 2.531e-03 [4.613e-02, 0.217]

PT[1] 0.9882 1.919e-02 51.487 0.000 [ 0.951, 1.026]

PT[12] -0.0574 1.891e-02 -3.037 2.386e-03 [-9.451e-02,-2.038e-02]

Volatility Model

========================================================================

coef std err t P>|t| 95.0% Conf. Int.

------------------------------------------------------------------------

sigma2 0.1699 1.918e-02 8.859 8.041e-19 [ 0.132, 0.207]

========================================================================

Covariance estimator: White's Heteroskedasticity Consistent Estimator

forecasts = res_arch_ar_model.forecast(reindex=False, horizon=6)

forecasts.mean

| h.1 | h.2 | h.3 | h.4 | h.5 | h.6 | |

|---|---|---|---|---|---|---|

| date | ||||||

| 2022-01-01 | 3.498751 | 3.610983 | 3.736772 | 3.82449 | 3.983794 | 4.034121 |

forecasts.variance

| h.1 | h.2 | h.3 | h.4 | h.5 | h.6 | |

|---|---|---|---|---|---|---|

| date | ||||||

| 2022-01-01 | 0.193844 | 0.375625 | 0.555719 | 0.736862 | 0.91979 | 1.104713 |