Appilcations of state space models

Contents

Appilcations of state space models¶

ARMA(p,q) models¶

Example

MA(1)

State space form

Example ARMA(2,1)

State space form

Generalizes to ARMA(p,q)

Unobserved-components models¶

Example

State space form

State space form for the level of \(z_t\)

Time-varying parameters¶

Dynamic Factor models¶

Example

State Space form

can be extended to multiple factors evolving as VAR(q)

and more general AR processes for the idiosyncratic components

DFM are a parsimoneous alternative to VARs with many series

Dynamic factor models in Statsmodels

related common trend model

State Space form

\(z_{1,t}\) and \(z_{2,t}\) share a common stochastic trend - cointegrated

the stationary terms can have more complicated dynamics, and may be correlated (e.g VAR instead of AR processes)

The Hodrick-Prescott filter¶

Unobserved components model

State space form

no parameters are estimated

the parameters can be estimated and the restrictions tested

Why You Should Never Use the Hodrick-Prescott Filter

import statsmodels.tsa.api as tsa

from pathlib import Path

import pandas as pd

import matplotlib.pyplot as plt

from fredapi import Fred

fred = Fred(api_key=your_api_key)

start = '1948-01'

end = '2022-01'

df_raw = fred.get_series('GNPC96', observation_start=start, observation_end=end)

df_raw.index.freq = 'QS'

df_raw.name = 'gdpc1'

df_raw = df_raw.to_frame()

df_raw.head()

| gdpc1 | |

|---|---|

| 1948-01-01 | 2102.422 |

| 1948-04-01 | 2137.588 |

| 1948-07-01 | 2149.832 |

| 1948-10-01 | 2152.212 |

| 1949-01-01 | 2122.155 |

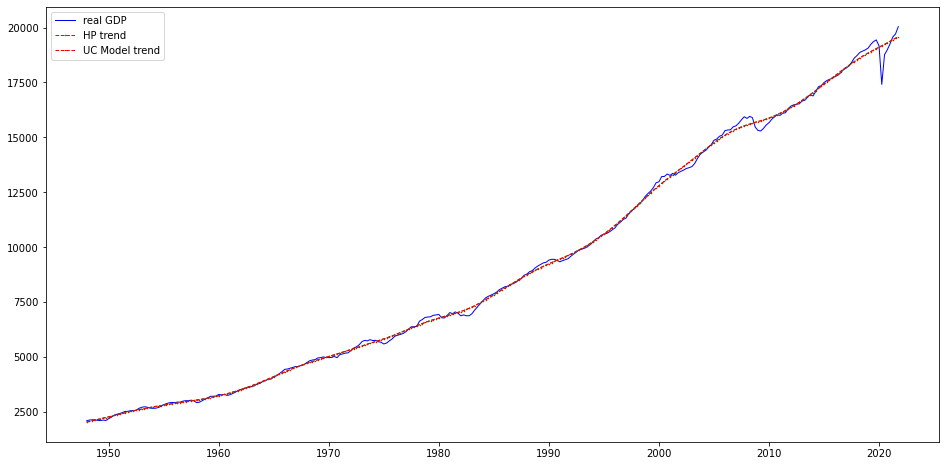

hp_cycle, hp_trend = tsa.filters.hpfilter(df_raw[['gdpc1']], lamb=1600)

mod = tsa.UnobservedComponents(df_raw[['gdpc1']], 'lltrend')

res = mod.smooth([1., 0, 1. / 1600]) # 'sigma2.irregular', 'sigma2.level', 'sigma2.trend'

#print(res.summary())

ucm_trend = pd.Series(res.level.smoothed, index=df_raw[['gdpc1']].index)

fig, ax = plt.subplots(figsize=(16, 8))

ax.plot(df_raw[['gdpc1']], label='real GDP', color='blue', linestyle='solid', linewidth=1)

ax.plot(hp_trend, label='HP trend', color='green', marker='o', linestyle='dashed', linewidth=1, markersize=.5)

ax.plot(ucm_trend, label='UC Model trend', color='red', marker='+', linestyle='dashed', linewidth=1, markersize=.5)

ax.legend();

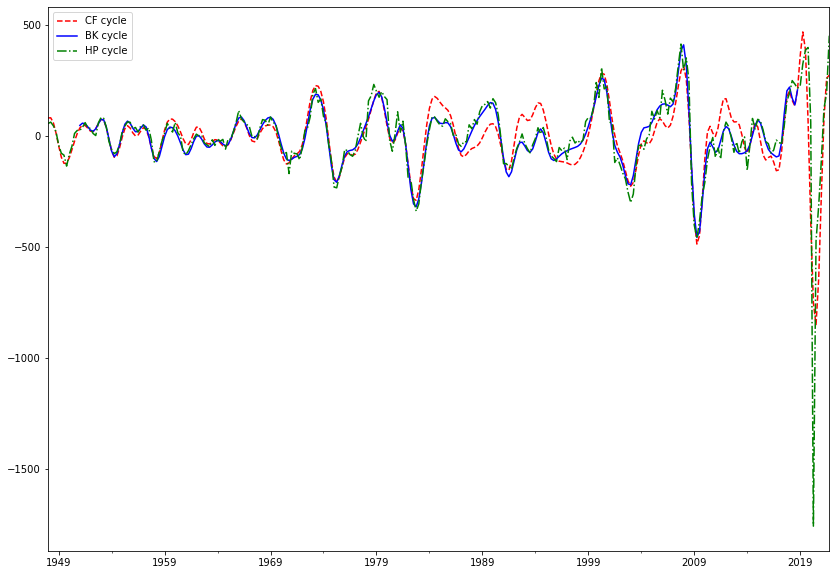

Frequency-domain filters¶

time series can be thought of as the sum of periodic functions (fluctuations)

frequency domain, spectral analysis of time series

business cycle components of time series correspond a subset of those fluctuations

those with period greater than 1.5 (or 2) years and less than 8 years

faster (shorter period) or slower (longer period) fluctuations are interpreted as being outside the business cycle

low, business cycle, high frequencies

frequency-domain filters aim to extract the business cycle components

Baxter-King, Christiano-Fitzgerald

periodic functions?

\(\cos(x) = \cos(x + 2 k \pi), \;\;\; k = 1, 2, \cdots\)

\(\sin(x) = \sin(x + 2 k \pi), \;\;\; k = 1, 2, \cdots\)

as function of time: \(\cos(t \omega), \;\;\;t = t_1, \; t_2, \cdots \)

periodicity means that

\(\omega\) is the frequency, \(t_h - t_1\) is the period

a time series \(z_t\) can be represented as a sum (integral) of

business cycle component contains only those components with period between 1.5 and 8 years

with quarterly data: \(\frac{2 \pi}{32} \leq \omega\leq \frac{2 \pi}{6}\)

with monthly data: \(\frac{2 \pi}{96} \leq \omega\leq \frac{2 \pi}{18}\)

band-pass filter: keep only a subset (band) of \(\omega\)’s in \((0, \pi)\)

both Baxter-King and Christiano-Fitzgerald filters are computed as weighted moving averages of the series, the difference is in what the weights are

symmetric (BK) vs asymmetric (CF) weights

truncated on both ends (BK) vs using the full sample (CF)

bk_cycle = tsa.filters.bkfilter(df_raw[['gdpc1']])

cf_cycle, _ = tsa.filters.cffilter(df_raw[['gdpc1']])

cf_cycle.name = 'CF cycle'

bk_cycle.columns = ['BK cycle']

hp_cycle.name = 'HP cycle'

fig = plt.figure(figsize=(14, 10))

ax = fig.add_subplot(111)

cf_cycle.plot(ax=ax, style=["r--", ], legend=True)

bk_cycle.plot(ax=ax, style=["b-", ], legend=True)

hp_cycle.plot(ax=ax, style=["g-.", ], legend=True)

<AxesSubplot:>

Frequency domain log-likelihood¶

Whittle log-likelihood

\(f_{\mathbf{z}}(\omega, \boldsymbol \theta)\) is the model-implied spectral density of \(\mathbf{z} \) at \(\omega\)

\(I(\omega, \mathbf{z})\) is the periodogram of \(\mathbf{z}\) at \(\omega\)

it is like a Gaussian log-likelihood for independent observations

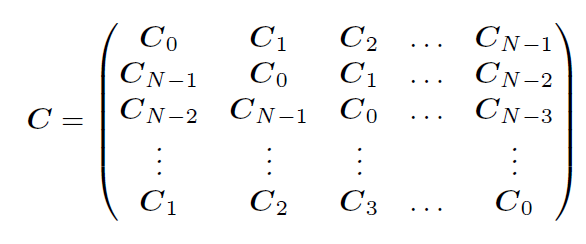

can be derived by approximating the covariance matrix of \(\mathbf{z}\) by a block circulant matrix, which can be diagonalized using DFT

\[ \mathbf{z}^{\prime} \mathbf{\Sigma}^{-1}(\mathbf{\theta}) \mathbf{z} \approx \operatorname{tr}\left( \mathbf{z}^{\prime} \mathbf{C}^{-1}(\mathbf{\theta}) \mathbf{z} \right) = \operatorname{tr}\left( \mathbf{z}^{\prime} V^{\prime}\mathbf{F}^{-1}(\mathbf{\theta}) V \mathbf{z} \right) = \sum_{\omega}\operatorname{tr}\left(f(\omega, \boldsymbol \theta)^{-1} I(\omega, \mathbf{z}) \right) \]

Block circulant matrix

The Whittle log-likelihood can be used as

an alternative to the Kalman filter

a way to estimate a model using only a subset of frequencies, e.g. BC frequencies

QUANTIFYING CONFIDENCE (2018) by Angeletos, Collard, Dellas