Regime-switching models

Contents

import matplotlib.pyplot as plt

import pandas as pd

from fredapi import Fred

fred = Fred(api_key="your_api_key")

start = '1948-01'

end = '2022-01'

unr = fred.get_series('UNRATE', observation_start=start)

unr.index.freq = unr.index.inferred_freq

unr.name = 'Unemployment'

recessions = fred.get_series('USREC', observation_start=start, observation_end=end)

recessions.name='recessions'

df = pd.merge(unr, recessions, how='outer', left_index=True, right_index=True)

df = df.fillna(value=0)

df.index.freq = df.index.inferred_freq

dates = df.index._mpl_repr()

indpr = fred.get_series('INDPRO', observation_start=start, observation_end=end)

indpr.index.freq = indpr.index.inferred_freq

indpr.name = 'Industrial production'

indpr = indpr.to_frame()

Regime-switching models¶

Motivation¶

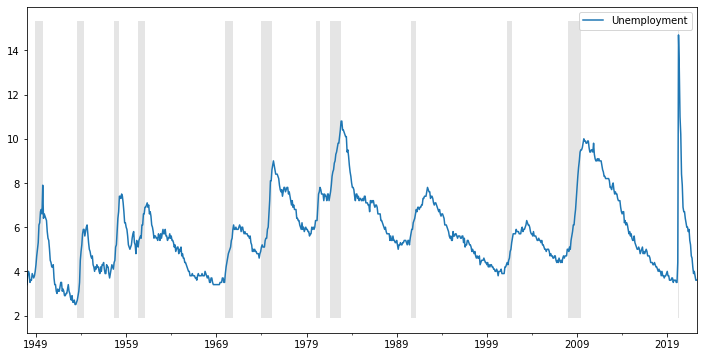

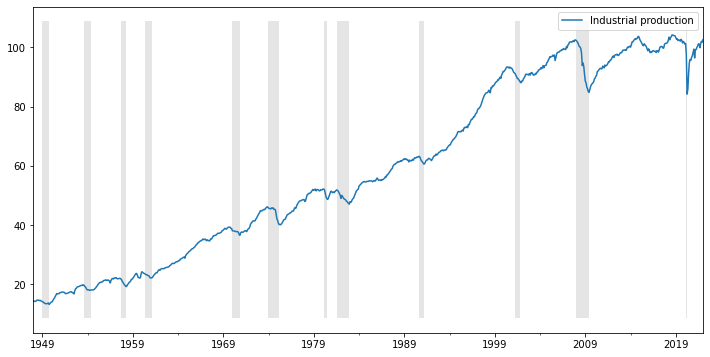

empirically, economic contractions are steeper and more short-lived than expansions

fig, ax = plt.subplots(figsize=(12,6))

df[['Unemployment']].plot(ax=ax)

ylim = ax.get_ylim()

ax.fill_between(dates, ylim[0], ylim[1], df[['recessions']].values.flatten(), facecolor='k', alpha=0.1);

fig2, ax = plt.subplots(figsize=(12,6))

indpr.plot(ax=ax)

ylim = ax.get_ylim()

ax.fill_between(dates, ylim[0], ylim[1], df[['recessions']].values.flatten(), facecolor='k', alpha=0.1);

asymmetry between different phases of the business cycle

linear models rule out different dynamics of variables during contractions and expansions

contractions are much less common part of the sample

trend-cycle decompositions based on linear models are better at representing dynamics during expansions.

non-linear models may be better at capturing the business cycle asymmetry

asymmetry may be explained by different propagation mechanism in contractions vs expansions, or by asymmetry in the shocks

capacity constraints, monopoly power, downward vs upward price/wage stickiness, etc

Regime-switching AR§ model¶

if \(S_t\) is known (observed) this model can be estimated in the usual way by MLE or OLS using dummies

not very appealing as this assumes regime switches are deterministic - can be predicted

if \(S_t\) is unobserved, we cannot condition on \( S_t, S_{t-1}, ..., S_{t-p}\), and have to work with

integrate out \(S_t, S_{t-1}\) from the joint density \(p(z_t, S_t, S_{t-1} | Z_{t-1})\) by summing over all possible values of \(S_t\) and \(S_{t-1}\)

using

we have

\(p(z_t | S_t, S_{t-1}, Z_{t-1})\) computed as before (for known \(S_t\))

Hamilton filter (Hamilton (1989)):

assumes time-invariant Markov chain

what if \(p_{1,1} = 1?\)

restrictions?

computes \(\operatorname{Pr}(S_t=i, S_{t-1}=j | Z_{t-1})\) iteratively starting with the unconditional probabilities

Markov-switching models in Statsmodels¶

Two classes of models:

markov-switching dynamic regression models

where both \(x_t\) and \(y_t\) may include lags of \(z_t\)

\(z_t\) depends only on the current state (the intercept has 2 possible values for a model with 2 states)

markov-switching autoregression models

\(z_t\) depends on the current and past states (the intercept has 4 possible values for a model with 2 states when p=1)